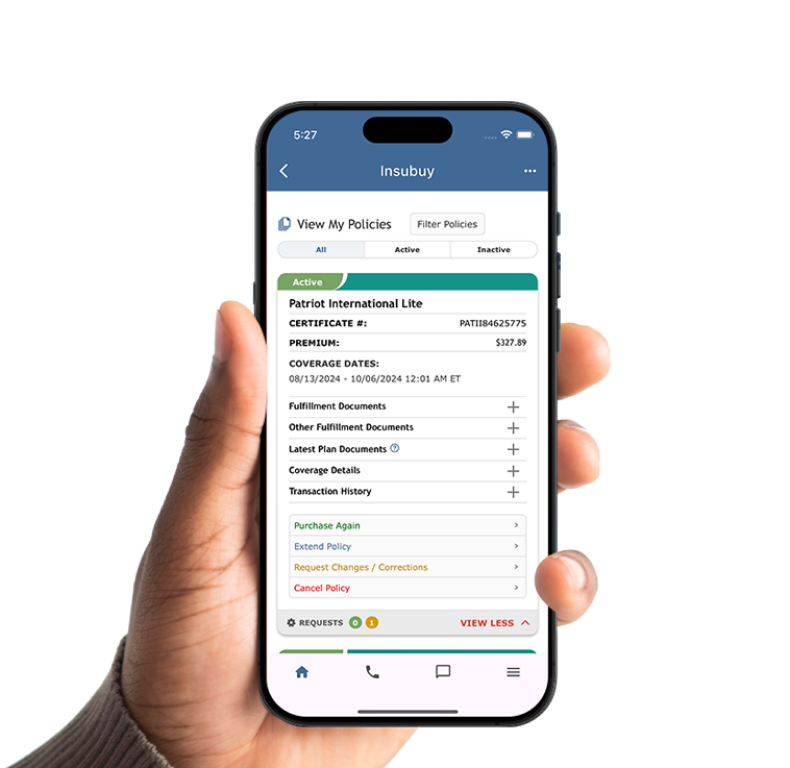

Insubuy isn't just an insurance broker, we're a full-service partner to our customers.

Whether you are a new permanent resident, have a green card and are simply visiting the USA, have moved to USA on a Fiancé visa, or are a temporary worker such as H or L visa, we have medical insurance for you.

Visitors Insurance

Purchase visitors medical insurance for relatives visiting the USA and protect them from unexpected high costs.

New Immigrants

If you or a family member are a new immigrant to the US, you are required to show proof of health insurance before getting an immigrant visa to enter the U.S.

Visiting with Greencard

If you have a greencard, but are simply visiting the USA for a short period, we have specific travel medical insurance plans that would cover your stay in the US.

COVID-19 Travel Medical Insurance

Get quotes for trips to the USA or outside the USA when you or your family member need travel medical insurance that covers new coronavirus infections.

Fiance Visa

As individuals entering the US on Fiancé visa may not qualify for major medical insurance through their spouse until getting married, they can purchase temporary medical insurance.

Temporary Workers

If you are on H, L or other similar visa in the US and don't qualify for PPACA compliant insurance, you may be able to purchase short term medical insurance.

If you are studying outside the US or are on OPT in the US while on an F1 visa, you can purchase medical insurance. Alternatively, standalone evacuation and repatriation plan can help those that already have medical insurance.

International Students (F1/F2)

International student insurance that meets the requirements of many US universities. Waiver form completion help available.

Exchange Visitors (J1/J2)

J visa insurance fully meets U.S. Department of State requirements including medical evacuation and repatriation.

OPT

Once you have graduated from a US school and are on OPT, you can purchase specific medical insurance plan to cover you.

Study Abroad

If you are studying abroad for any duration, study abroad insurance can help cover unexpected medical emergencies.

Evacuation / Repatriation

If you already have medical insurance through your school, purchase standalone medical evacuation and repatriation insurance to meet insurance requirements.

Whether you are traveling domestically or internationally, various types of travel insurance plans can protect you.

Trip Insurance

Trip cancellation insurance can protect against trip cancellation, trip interruption, evacuation, repatriation and more.

Travel Outside USA

Your domestic health insurance may not cover you overseas. Purchase affordable travel medical insurance.

Schengen Visa

Get an instant visa letter for Schengen visa.

Flight Accident

Flight insurance primarily provides a lump sum benefit to the beneficiary in case of a flight accident.

Multi Trip

For those traveling frequently throughout the year, annual multi-trip insurance plans are most suitable.

AD&D

AD&D insurance plans offer a limited form of life insurance that provides Accidental Death & Dismemberment benefits.

Group Travel

If you are a group of five or more travelers, purchasing group travel insurance would cost less, while providing the same benefits as individual travel insurance.

Missionary Travel

Missionary travel insurance protects missionaries traveling overseas for a short duration and provides medical, evacuation and repatriation coverage, among other plan benefits.

Kidnap & Ransom

Are you traveling to an area where you are worried that you or your family member might be kidnapped and held for ransom abroad? Kidnap and ransom insurance can provide valuable coverage when you need it most.

For those living abroad—whether on assignment, retired, at sea, or on a mission—international private medical insurance (iPMI) provides essential, long-term health coverage for peace of mind.

Expatriates

Expatriate health insurance offers renewable major medical coverage for individuals and families who spend most of their time living outside the US, including retirees and long-term travelers.

Marine Crew

When you are a marine crewmember, captain, or in the cruise industry, you are mostly outside the US, long term international health insurance can provide valuable coverage where you need it.

Career Missionaries

Career missionaries should consider purchasing annually renewable, long term major medical insurance plan. These plans provide coverage for preventive care, wellness checkups, and optional maternity coverage.

US residents can consider purchasing short term medical insurance, disability income protection plans, dental plans, and even group medical plans.

Short Term Medical

Individuals between jobs, recent graduates or those who missed open enrollment can purchase short term medical insurance plans.

Disability

If you were to get sick or injured and can no longer work, disability insurance can provide income protection. Primary, as well as supplemental coverage can be purchased.

Group Medical

Companies of any size can offer a valuable benefit to employees and their dependents by providing them with group medical insurance.

Dental

US residents, visitors and anyone else present in USA can enroll into dental and vision discount plans and can save significant amounts when visiting in-network providers.

Vision Plans

Anyone in the U.S., including residents and visitors, can join a vision discount plan to enjoy substantial savings when using in-network providers.

Browse our extensive catalogue of articles that cover a wide range of topics like travel and medical insurance, students and exchange visitors insurance, claims, destinations, and activities.

Stay up-to-date on the latest news in travel and medical insurance, visitors insurance, and student insurance for a wide range of activities and destinations with the insurance blog.

Over two decades of excellent customer experiences, read what customers are saying about Insubuy.

For 25 years, Insubuy has been a trusted partner to international travelers, providing support for your health and safety throughout your journey and beyond.